The Ultimate Guide To Virtual Terminal

Wiki Article

The 6-Second Trick For Virtual Terminal

Table of ContentsOur Credit Card Processing Companies DiariesCredit Card Processing Fundamentals ExplainedThe Ultimate Guide To Credit Card ProcessingFacts About Credit Card Processing Fees Uncovered5 Simple Techniques For Clover GoRumored Buzz on First Data Merchant ServicesOur Online Payment Solutions StatementsThe Only Guide to First Data Merchant ServicesThe Basic Principles Of Clover Go

One of the most typical grievance for a chargeback is that the cardholder can not keep in mind the transaction. The chargeback ratio is really low for deals in an in person (POS) setting. See Chargeback Administration.You don't require to become a professional, however you'll be a far better customer if you understand exactly how debt card processing really functions. That are the actors in a debt as well as debit card transactions?

Not known Facts About Payment Hub

That's the credit scores card process in a nutshell. The charges the account for the amount of the deals. The then transfers suitable funds for the transactions to the, minus interchange fees.

The 5-Second Trick For First Data Merchant Services

You can get a merchant account through a settlement processing business, an independent specialist, or a large financial institution. Without it, you would certainly have no place to keep the cash your customers pay you. A repayment handling company or banks handles the purchases in between your clients' banks and your financial institution. They handle such questions as bank card legitimacy, available funds, card limitations, and so forth.You must permit sellers to accessibility details from the backend so they can see background of payments, terminations, and other deal data. PCI Security helps vendors, sellers, and financial organizations execute requirements for producing safe and secure payment services.

Excitement About Credit Card Processing Companies

Various other disadvantages consist of high rates for some types of repayment handling, limitations on the number of purchases per day and quantity per purchase, this contact form as well as protection openings. There's also a selection of on-line payment processing software application (i.

merchant accounts, sometimes with occasionally payment gateway)Portal Another selection is an open source payment handling system.

The 8-Minute Rule for Online Payment Solutions

They can additionally make your cash flow a lot more predictable, which is something that every small company proprietor pursues. Figure out even more how about B2B settlements function, and which are the ideal B2B payment items for your little company. B2B settlements are settlements made in between two sellers for products or solutions.

3 Simple Techniques For Clover Go

People involved: There are numerous people entailed with each B2B purchase, including receivables, accounts payable, invoicing, and also purchase teams. Payment delay: When you pay a buddy or relative for something, it's often ideal on-site (e. g. at the restaurant if you're splitting a costs) or just a few hours after the event.Due to the intricacy of B2B settlements, a growing number of services are selecting trackable, digital settlement alternatives. Fifty-one percent of companies still pay by check, declining from 81% in 2004. As well as 44% of organizations still receive repayment by check, decreasing from 75% look at here in 2004. There are 5 main methods to send and receive B2B repayments: Checks This category consists of traditional paper checks as well as digital checks released by a purchaser to a seller.

Things about Payeezy Gateway

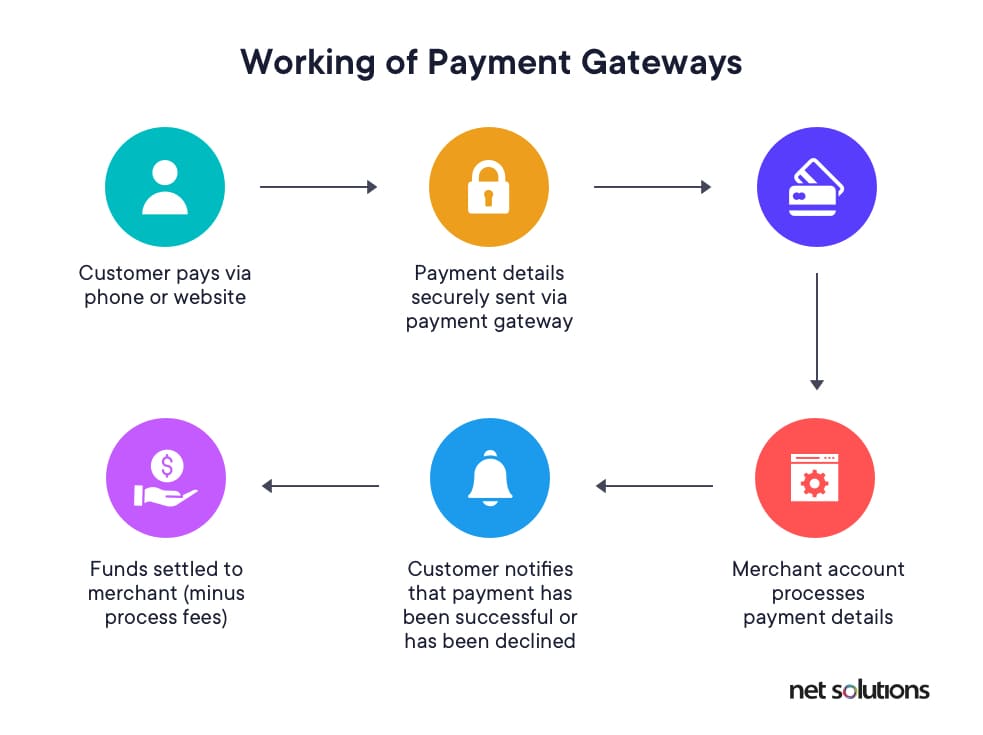

Digital financial institution transfers These are payments in between banks that are routed with the Automated Cleaning Residence (ACH). This is one of the most safe and also dependable payment systems, but financial institution transfers take a few days longer than cord transfers.Repayment gateway A payment gateway is an online settlement system that enables the customer to spend for items or services online throughout the checkout procedure. Each choice differs in simplicity of use for the sender as well as recipient, expense, and also safety. That claimed, most companies are changing away from paper checks and also approaching electronic and also electronic settlements.

The Buzz on Fintwist Solutions

Payments software program and apps have reports that offer you a review of your balance dues and accounts payable. If there a couple of sellers that on a regular basis pay you late, you can either impose stricter target dates or quit functioning with them. B2B repayment options additionally make it easier for your consumers to pay you, helping you get repayment quicker.Report this wiki page